pay indiana tax warrant online

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Where can I get information about the 125 Automatic Taxpayer Refund.

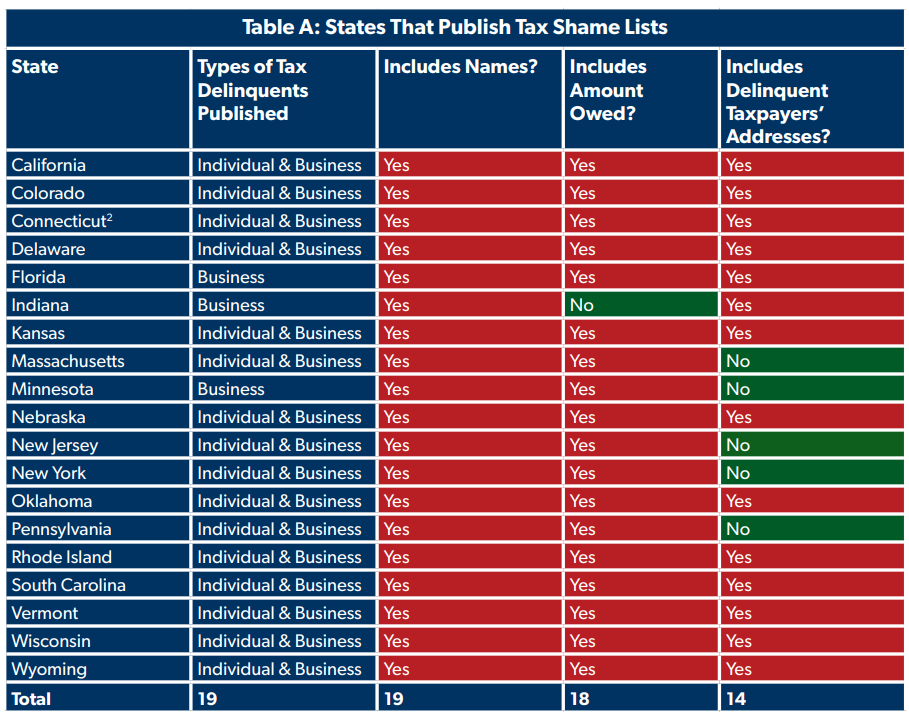

At Least 19 States Still Publish Draconian Shame Lists For Delinquent Taxpayers Foundation National Taxpayers Union

Pay my tax bill in installments.

. Whether the warrant is subject to any pending litigation. Do not call the Hendricks County Sheriffs Office as this agency has nothing to do with setting the amount of taxes owed. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Hamilton County Sheriffs Office 18100 Cumberland Road. Property Tax Payment Coupons.

Tax Liabilities and Case Payments. Take the renters deduction. Approved Forms of Payment.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you wish to make payment arrangements contact the Sheriffs Office at 812-547-2441. You should also know the amount due.

Revenue Department of 19 Articles. Was this article helpful. Search for your property.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. Acceptable Forms of Payment by Mail or in Office. Tax Sale - IC 6-11-24-10.

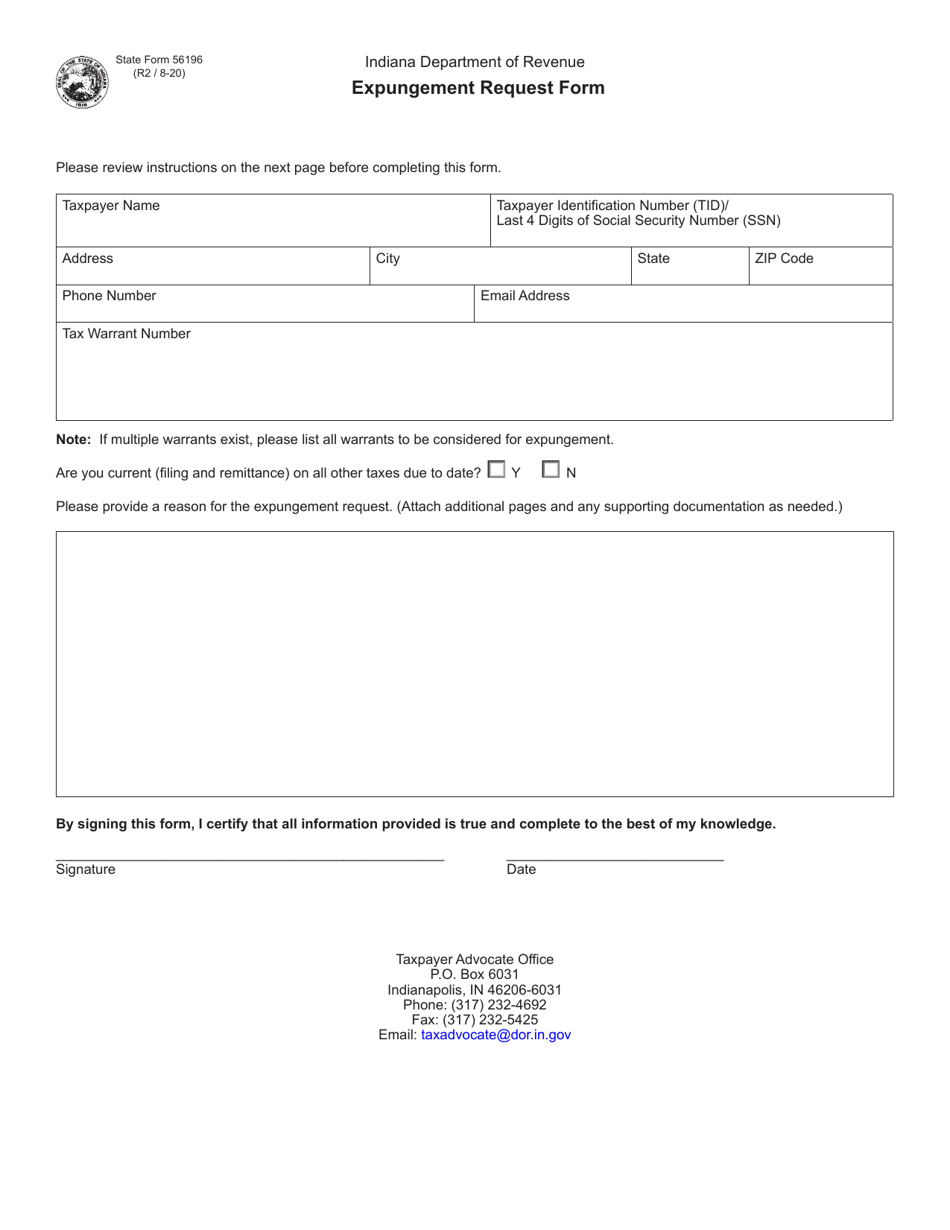

INTAX only remains available to file and pay special tax obligations until July 8 2022. Know when I will receive my tax refund. Please note an expungement will not be granted if the warrant was issued based on a taxpayers fraudulent intentional or reckless conduct.

Perry County Sheriffs Office. Our service is available 24 hours a day 7 days a week from any location. For best search results enter a partial street name and partial owner name ie.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Claim a gambling loss on my Indiana return. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail.

124 Main rather than 124 Main Street or Doe rather than John Doe. You may come to our office and pay by cashiers check certified check or money order. Whether the taxpayer owed the tax for which the warrant was issued.

Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Developed by WTH this innovative technology provides revolutionary capabilities including pin-point mapping synchronized data sharing and instant software updates together with industry-leading customer support. Where do I go for tax forms.

Tax Warrant Payment Methods. Doxpop provides access to over current and historical tax warrants in Indiana counties. Why did I receive a tax bill for underpaying my estimated taxes.

745 out of 1456 found this helpful. Mail - Payable to. Have more time to file my taxes and I think I will owe the Department.

Think GIS is one of the worlds most accessible GIS software solutions. Cash Please do not mail cash CreditDebit Cards Please do not mail debitcredit card information Money Order. Search by address Search by parcel number.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. After you have read your letter and wish to set up a payment plan you may call the Hendricks County Sheriffs.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. If you are disputing the amount owed call the Department of Revenue at. Failure to Pay Mobile Home Tax Demand NoticesJudgmentsPayments to AFCS.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. Find Indiana tax forms. Whether the warrant was properly issued according to statute or DOR procedures.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Mobile Home Taxation Regulations. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices. Personal Business or Cashiers Check. Tax Warrant Payment Methods.

Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check. You can pay online by visiting httpsintimedoringoveServices. Tell City IN 47586.

Indiana Dept Of Revenue Inrevenue Twitter

Dor Owe State Taxes Here Are Your Payment Options

Indiana Dept Of Revenue Inrevenue Twitter

Indiana Dept Of Revenue Inrevenue Twitter

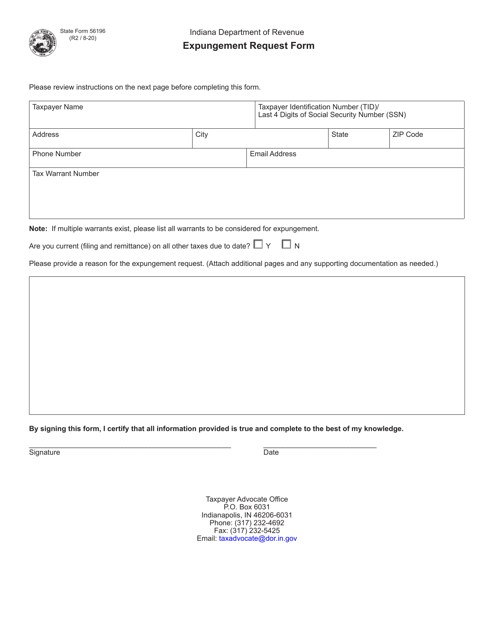

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Dor Indiana Extends The Individual Filing And Payment Deadline

Indiana Dept Of Revenue Inrevenue Twitter

Dor Owe State Taxes Here Are Your Payment Options

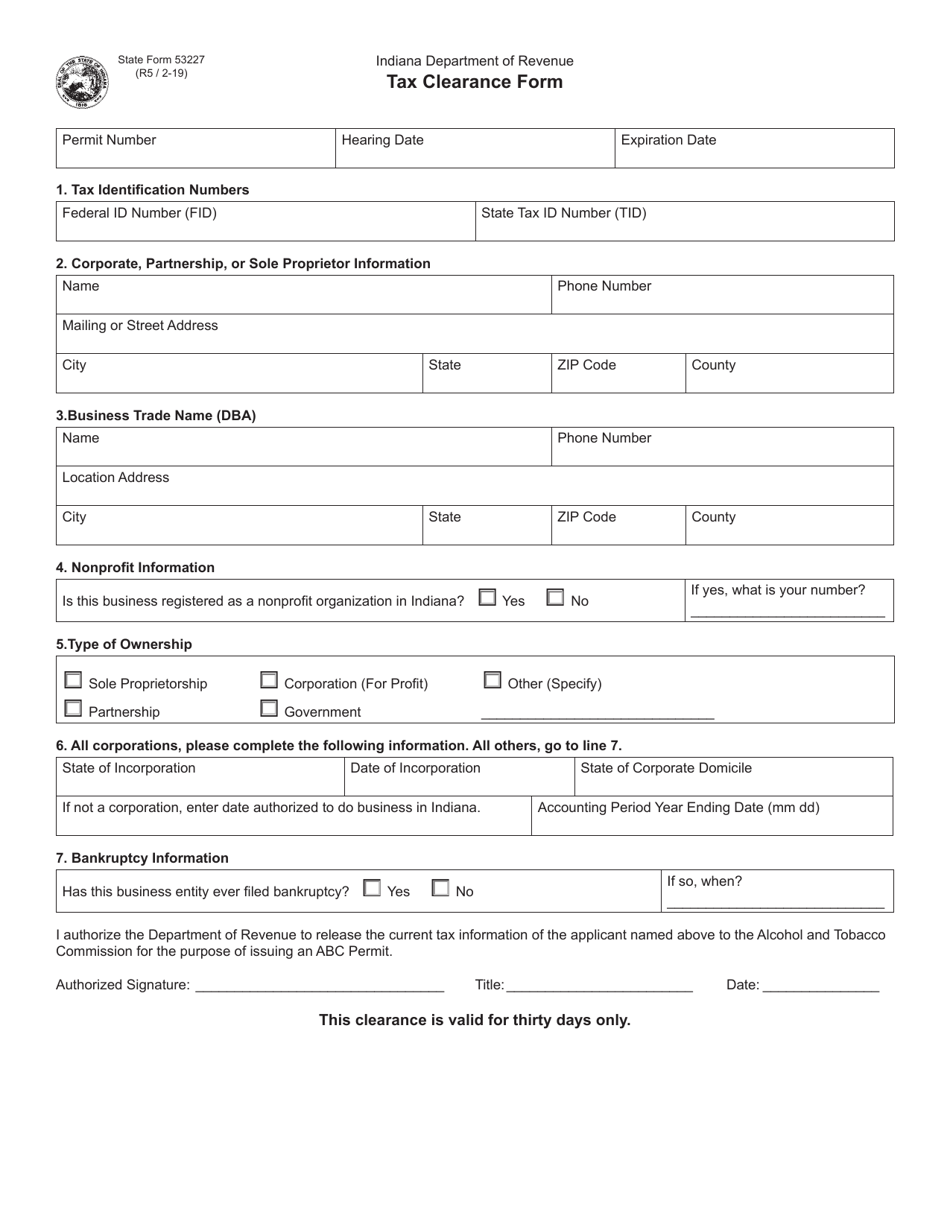

State Form 53227 Download Fillable Pdf Or Fill Online Tax Clearance Form Indiana Templateroller

Indiana Department Of Revenue Linkedin

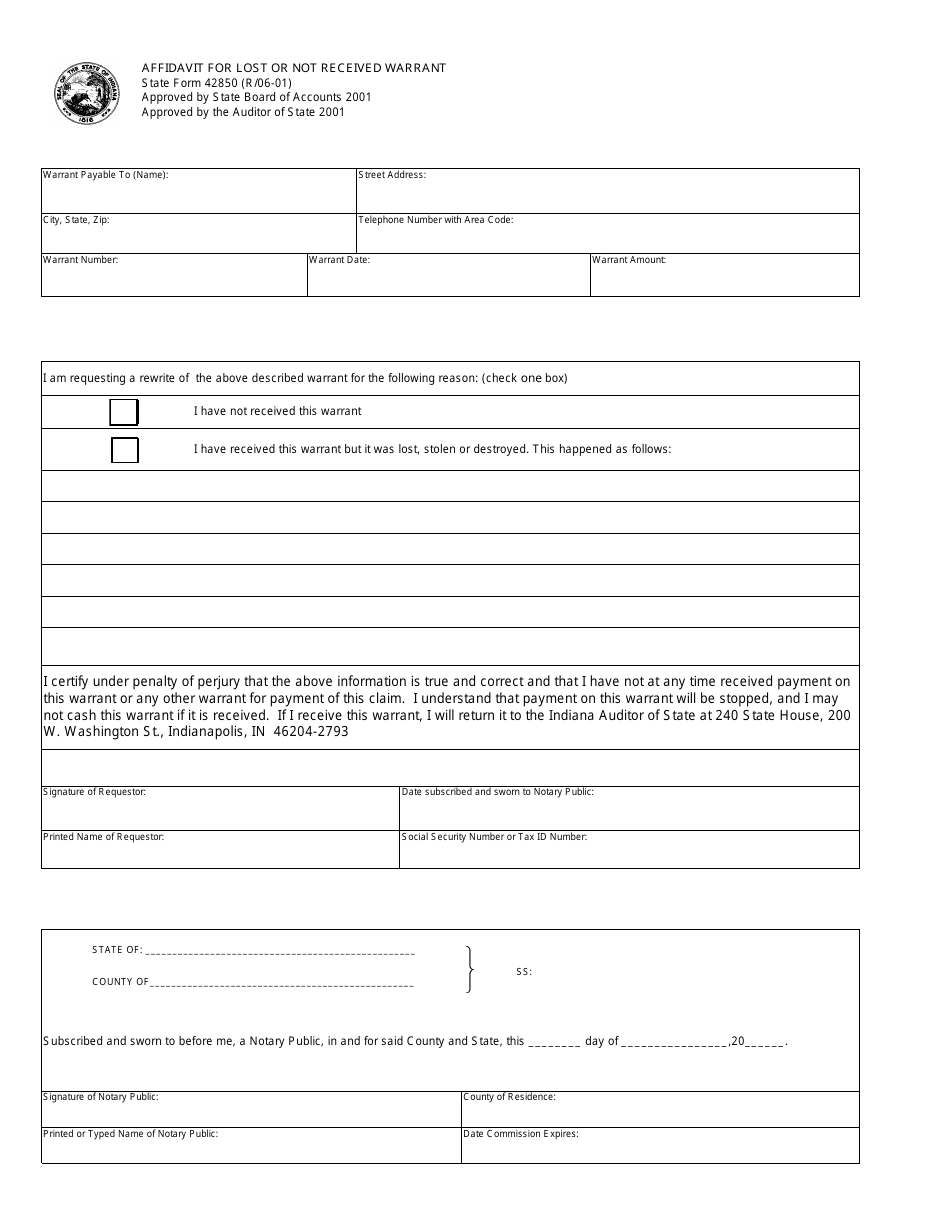

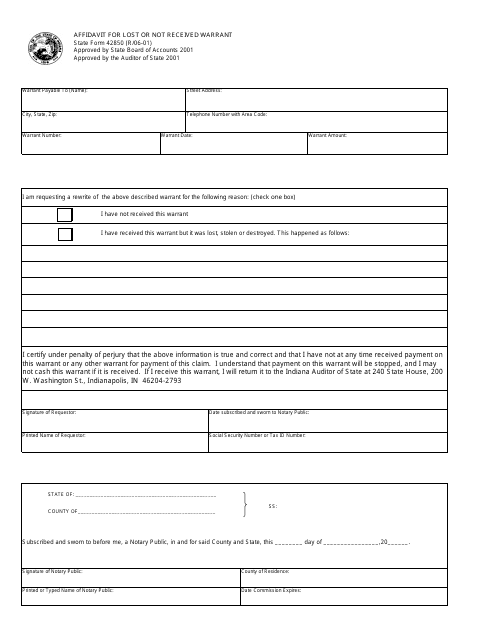

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

Dor Make Estimated Tax Payments Electronically

Indiana Dept Of Revenue Inrevenue Twitter

Dor How To Make A Payment For Individual State Taxes

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller